Sell short 60 URS 45 stop 44.87 limit GTC

Sell short 60 EOC 46 stop 45.85 limit GTC

Technical Analysis of the Financials Markets, Swing Trading Speculation

Hi, these are just ideas not recommendations, sometimes I trade my ideas, sometimes I don’t.

Always remember, yours is the responsibility for your trades,

Good luck,

Erick

Always remember, yours is the responsibility for your trades,

Good luck,

Erick

Tuesday, August 25, 2009

Monday, August 24, 2009

Buy Orders

Buy 325 DBTK at the open limit 9.13

Buy 140 WFT 21 stop 21.13 limit GTC

Buy 400 ERES 7 stop 7.13 limit GTC

Buy 80 TDY 36 stop 36.13 limit GTC

Buy 140 WFT 21 stop 21.13 limit GTC

Buy 400 ERES 7 stop 7.13 limit GTC

Buy 80 TDY 36 stop 36.13 limit GTC

Sunday, August 9, 2009

Buy Orders

Buy 300 SMA 9.5 STOP 9.63 LIMIT GTC

Buy 250 RPT 11 STOP 11.13 LIMIT GTC

Buy 300 KG 10.5 STOP 10.63 LIMIT GTC

Buy 250 RPT 11 STOP 11.13 LIMIT GTC

Buy 300 KG 10.5 STOP 10.63 LIMIT GTC

Tuesday, July 21, 2009

Monday, July 20, 2009

Orders

The following orders are in place;

All shares buy to cover good until canceled stop at:

XLI at 23

CECO at 22.5

AIPC at 32.13

AVY at 27

IPHS at 17.5

BKE at 33.13

New orders buy good until canceled stop-limit

80 QQQQ at 38-38.13

70 OEF at 45-45.13

70 IXN at 48-48.13

70 IJR at 47.70-47.87

All shares buy to cover good until canceled stop at:

XLI at 23

CECO at 22.5

AIPC at 32.13

AVY at 27

IPHS at 17.5

BKE at 33.13

New orders buy good until canceled stop-limit

80 QQQQ at 38-38.13

70 OEF at 45-45.13

70 IXN at 48-48.13

70 IJR at 47.70-47.87

Sunday, July 12, 2009

New and changed orders

I am reshuffling old orders, canceling some and adding new ones.

Canceled orders:

Buy Agilent Tech (A)

Sell short Anadarko (APC)

Sell short Dean Food (DF)

Sell short Supervalu (SVU)

Protective Stop Orders:

All shares buy to cover stop, good until canceled

AIPC @ 32.13

AVY @ 27

BKE @ 33.13

BRY @ 18.55

CECO @ 26

IPHS @ 17.50

XLI @ 25

All shares sell stop, good until canceled

SKF @ 40

Buy or sell short open orders:

Sell short orders good until canceled:

80 SPW 43 stop 42.87 limit

200 EAT 15 stop 14.87 limit

140 ADM 25 stop 24.87 limit

Buy orders good until canceled:

60 SIJ 51.25 stop 51.40 limit

55 SDS 62 stop 62.15 limit

45 SCC 70 stop 70.15 limit

65 REW 45 stop 45.13 limit

80 QID 37 stop 37.15 limit

Canceled orders:

Buy Agilent Tech (A)

Sell short Anadarko (APC)

Sell short Dean Food (DF)

Sell short Supervalu (SVU)

Protective Stop Orders:

All shares buy to cover stop, good until canceled

AIPC @ 32.13

AVY @ 27

BKE @ 33.13

BRY @ 18.55

CECO @ 26

IPHS @ 17.50

XLI @ 25

All shares sell stop, good until canceled

SKF @ 40

Buy or sell short open orders:

Sell short orders good until canceled:

80 SPW 43 stop 42.87 limit

200 EAT 15 stop 14.87 limit

140 ADM 25 stop 24.87 limit

Buy orders good until canceled:

60 SIJ 51.25 stop 51.40 limit

55 SDS 62 stop 62.15 limit

45 SCC 70 stop 70.15 limit

65 REW 45 stop 45.13 limit

80 QID 37 stop 37.15 limit

Monday, June 29, 2009

New orders

The following orders are in place

All Shares good until canceled Buy to cover:

ANW stop 16

AVY stop 30

AIPC stop 32.13

CECO stop 26

BRY stop 23

IPHS stop 17.5

All Shares good until canceled Sell:

SKF stop 37

New order to buy:

Agilent (A) buy 180, 21 stop 21.15 limit good until canceled

All Shares good until canceled Buy to cover:

ANW stop 16

AVY stop 30

AIPC stop 32.13

CECO stop 26

BRY stop 23

IPHS stop 17.5

All Shares good until canceled Sell:

SKF stop 37

New order to buy:

Agilent (A) buy 180, 21 stop 21.15 limit good until canceled

Monday, June 22, 2009

New orders

Cancel these orders:

June 14

Buy 60 IWD @ 51

Buy 50 IWW @ 65

Buy 60 VBK @ 51

May 8

Sell short 70 CMP @ 47

Open the following orders:

Sell short 200 EAT 15 stop 14.87 limit Good Till Canceled

Sell short 80 BKE 30 stop 29.87 limit GTC

June 14

Buy 60 IWD @ 51

Buy 50 IWW @ 65

Buy 60 VBK @ 51

May 8

Sell short 70 CMP @ 47

Open the following orders:

Sell short 200 EAT 15 stop 14.87 limit Good Till Canceled

Sell short 80 BKE 30 stop 29.87 limit GTC

Sunday, June 21, 2009

6/21/2009

Since I started this blog on April 26, the markets kept on climbing, the SP500 opened on Monday April 27 at 862.82 and closed last Friday at 921.23 for a 6.8% gain in the period, the Dow Industrial went from 8039.88 to 8539.73 resulting in a 6.13% gain, and the Nasdaq Composite started the period at 1671.21 and last Friday closed at 1827.47 for a 9.4% appreciation in less than 2 months.

Obviously my bearish stance has proved wrong until now, well I still have an overbought reading of the markets the only problem with that is nobody knows when this condition will end and the markets start to correct. That is why I made my three long orders which until now have not executed.

I believe right now is not the time to go long fully, maybe going short isn’t the answer either but I am keeping my bearish trades open.

I am changing my May 17 order to sell short XLI.

The new order:

Sell short 150 XLI 21 stop 20.87 limit GTC

Trade safe and remember your Gerald Appel.

Obviously my bearish stance has proved wrong until now, well I still have an overbought reading of the markets the only problem with that is nobody knows when this condition will end and the markets start to correct. That is why I made my three long orders which until now have not executed.

I believe right now is not the time to go long fully, maybe going short isn’t the answer either but I am keeping my bearish trades open.

I am changing my May 17 order to sell short XLI.

The new order:

Sell short 150 XLI 21 stop 20.87 limit GTC

Trade safe and remember your Gerald Appel.

Sunday, June 14, 2009

Going long

Buy 60 IWD 51 stop 51.13 limit GTC

Buy 50 IWW 65 stop 65.25 limit GTC

Buy 60 VBK 51 stop 51.25 limit GTC

Buy 50 IWW 65 stop 65.25 limit GTC

Buy 60 VBK 51 stop 51.25 limit GTC

Friday, May 29, 2009

Wednesday, May 27, 2009

APC technical analysis

Trading in the opposite direction of a prevailing trend is a dangerous and usually costly tactic. APC is trading inside an uptrend channel that is clearly visible on the accompanying graph, however a failure of the stock to reach the upper end of the channel is often an early warning that the lower line will be broken. That will mark a beginning of a down trend.

For this setup to work, APC most reverse direction without touching the upper line, right now the stock is going high, if APC reverses, I will be initiating a short position at 40.

The three weekly averages are in disarray, 10 is above 30 but they are both below the weekly ema(40), for APC to continue up, the stock must pass the 52.5 level reached at the beginning of may, a weekly close below 42 will definitively constitute a signal of closing all longs but not necessarily a short sell signal. Considering my belief on the weakness of the market now, I will start the short at that level.

For this setup to work, APC most reverse direction without touching the upper line, right now the stock is going high, if APC reverses, I will be initiating a short position at 40.

The three weekly averages are in disarray, 10 is above 30 but they are both below the weekly ema(40), for APC to continue up, the stock must pass the 52.5 level reached at the beginning of may, a weekly close below 42 will definitively constitute a signal of closing all longs but not necessarily a short sell signal. Considering my belief on the weakness of the market now, I will start the short at that level.

Monday, May 25, 2009

Thursday, May 21, 2009

Tuesday, May 19, 2009

New Order

Cancel Apr 26 order to sell short 110 HMSY

Open order to sell short 170 BRY 15.87 stop 15.75 limit GTC

Open order to sell short 170 BRY 15.87 stop 15.75 limit GTC

Monday, May 18, 2009

Sunday, May 17, 2009

XLI

Continuing with my bearish sentiment I’m adding one more short order.

Sell Short 150 XLI 20 stop 19.87 limit GTC

Sell Short 150 XLI 20 stop 19.87 limit GTC

IPHS

Innophos Holdings, Inc., .IPHS , a leading specialty phosphates producer in North America, announced its financial results for the first quarter 2009 on may 4. Net sales increased 17.4% quarter vs. quarter, Operating income for the first quarter 2009 was $55.3 million, an increase of $31.9 million, or 136%, versus $23.4 million for the comparable period in 2008, Net income for the first quarter 2009 was $30.2 million, an improvement of $20.9 million compared to $9.3 million for the same period in 2008, Diluted earnings per share for the first quarter 2009 were $1.39 compared to $0.43 for the first quarter of 2008.

With all those positive news the price action responded accordingly, on May 4 the stock closed almost 12% above May 1st closing price, the following day the price gained 14%. On May 7 the stock opened at 19 and closed at 14.57 for a 23% loss in one day, also the volume for the day was the highest for the last 7 months.

I reviewed various financial blogs and sites and could not find any significant news on May 7 that correlate with the price drop, in fact in most cases there is not any news for that date. So that makes me think that maybe some well informed people know something that I don’t. That huge volume in one day signals institutional trading, individuals doesn’t possess the means to be informed so what we do is we follow the action.

My sell short stop is right below the last support at 14.

Guys remember that these are my ideas, in no case I am recommending to follow these trades, in fact I don’t recommend anything in this blog now or never.

Actually this blog has been designed for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any security, which may be referenced upon the blog. Such offers can only be made where lawful under applicable law. The services and information provided through this blog are for personal, non-commercial use and display.

Always made your own research, that said, please: DO NOT RELY ON MY OPINIONS FOR ANY PURPOSE!

With all those positive news the price action responded accordingly, on May 4 the stock closed almost 12% above May 1st closing price, the following day the price gained 14%. On May 7 the stock opened at 19 and closed at 14.57 for a 23% loss in one day, also the volume for the day was the highest for the last 7 months.

I reviewed various financial blogs and sites and could not find any significant news on May 7 that correlate with the price drop, in fact in most cases there is not any news for that date. So that makes me think that maybe some well informed people know something that I don’t. That huge volume in one day signals institutional trading, individuals doesn’t possess the means to be informed so what we do is we follow the action.

My sell short stop is right below the last support at 14.

Guys remember that these are my ideas, in no case I am recommending to follow these trades, in fact I don’t recommend anything in this blog now or never.

Actually this blog has been designed for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any security, which may be referenced upon the blog. Such offers can only be made where lawful under applicable law. The services and information provided through this blog are for personal, non-commercial use and display.

Always made your own research, that said, please: DO NOT RELY ON MY OPINIONS FOR ANY PURPOSE!

Orders Recount

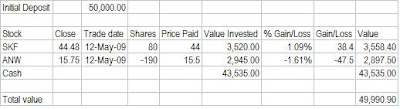

I started this portfolio on April 26 with an initial deposit of 50,000.00

So far the executed and open orders are as follow:

Initial Deposit: 50,000

Executed orders

Bought 80 SKF @ 44 : 3,520.00

Sold short 190 ANW @ 15.5: 2,945.00

Sold short 125 AVY @ 27: 3,375.00

Open orders

Sell short 140 CECO 19 stop 18.87 limit: 2,660.00

Sell short 70 CMP 47 stop 46.87 limit: 3,290.00

Buy 80 QID, 40 stop 40.23 limit: 3,200.00

Sell short 110 HMSY at 28 stop 27.87 limit: 3,080.00

Sell short 140 ADM 24 stop 23.87 limit: 3,360.00

Sell short 195 DF 17.37 stop 17.25 limit: 3,387.00

Cash available to trade: 21,183.00

So far the executed and open orders are as follow:

Initial Deposit: 50,000

Executed orders

Bought 80 SKF @ 44 : 3,520.00

Sold short 190 ANW @ 15.5: 2,945.00

Sold short 125 AVY @ 27: 3,375.00

Open orders

Sell short 140 CECO 19 stop 18.87 limit: 2,660.00

Sell short 70 CMP 47 stop 46.87 limit: 3,290.00

Buy 80 QID, 40 stop 40.23 limit: 3,200.00

Sell short 110 HMSY at 28 stop 27.87 limit: 3,080.00

Sell short 140 ADM 24 stop 23.87 limit: 3,360.00

Sell short 195 DF 17.37 stop 17.25 limit: 3,387.00

Cash available to trade: 21,183.00

Thursday, May 14, 2009

Tuesday, May 12, 2009

CECO

On May 6, Education company Career Education Corp, posted quarterly results that were below expectations, hurt by a plunge in revenue in one of its segments, even as other education companies posted strong profits.

Shares of the company dropped almost 10% closing at 19.17 with huge volume traded, on May 7. I’m always in the lookout for companies that drop in price after they posted quarterly results because most of the time that is a bad sign for the price action to come.

CECO is showing a support for more than 3 months at the 19.5 level and at the same time the stock is showing lower highs signaling a descent.

I’m selling short 140 shares of CECO if it breaks down support.

Orders

Sell short 140 CECO 19 stop 18.87 limit good until canceled.

Cancel the April 28 order to sell short 70 FCX.

Shares of the company dropped almost 10% closing at 19.17 with huge volume traded, on May 7. I’m always in the lookout for companies that drop in price after they posted quarterly results because most of the time that is a bad sign for the price action to come.

CECO is showing a support for more than 3 months at the 19.5 level and at the same time the stock is showing lower highs signaling a descent.

I’m selling short 140 shares of CECO if it breaks down support.

Orders

Sell short 140 CECO 19 stop 18.87 limit good until canceled.

Cancel the April 28 order to sell short 70 FCX.

Sunday, May 10, 2009

SKF

From March 9, banks stocks have experienced a huge price appreciation, Wells Fargo went from 9 to 28 for a 200% plus increase, JP Morgan was around 15 and is now at 38, Bank of America almost quintupled its price climbing from around 3 to almost 15 and Fifth Third was just about at 1 and now is above 8.

The financial sector bullish percent closed Friday at 80 in a territory that is considered high risk, contrary opinion calls for a correction of the financial sector.

The UltraShort Financials ProShares (SKF) is a leveraged short no diversified fund, the investment seeks daily investment results, before fees and expenses, which correspond to twice the inverse of the daily performance of the Dow Jones U.S. Financials index.

In others words this fund goes up if financials goes down.

Since March 9 to march 27 the fund went from 244 to 95 for a 60% loss in less than 3 weeks, the macd line correlated accordingly in that period. From March 27 to April 20 it went from 95 to 70 for a 26% loss, the macd line was bearish in that period but made a bullish crossover at the end.

Since April 20 the fund loss was a 44% to the close on Friday 8, however the macd line started climbing going from the 41 area to 50. We are in the presence of a bullish divergence. This divergences some times reflects a market bottom others time they don’t, nobody is sure of the actual outcome but the probabilities are on a price rebound.

Order

Buy 80 SKF 44 stop 46 limit good until canceled.

The financial sector bullish percent closed Friday at 80 in a territory that is considered high risk, contrary opinion calls for a correction of the financial sector.

The UltraShort Financials ProShares (SKF) is a leveraged short no diversified fund, the investment seeks daily investment results, before fees and expenses, which correspond to twice the inverse of the daily performance of the Dow Jones U.S. Financials index.

In others words this fund goes up if financials goes down.

Since March 9 to march 27 the fund went from 244 to 95 for a 60% loss in less than 3 weeks, the macd line correlated accordingly in that period. From March 27 to April 20 it went from 95 to 70 for a 26% loss, the macd line was bearish in that period but made a bullish crossover at the end.

Since April 20 the fund loss was a 44% to the close on Friday 8, however the macd line started climbing going from the 41 area to 50. We are in the presence of a bullish divergence. This divergences some times reflects a market bottom others time they don’t, nobody is sure of the actual outcome but the probabilities are on a price rebound.

Order

Buy 80 SKF 44 stop 46 limit good until canceled.

Friday, May 8, 2009

Tuesday, May 5, 2009

Sunday, May 3, 2009

AVY

On April 28 adhesive label maker Avery Dennison Corp. reported a first-quarter loss, due to hefty restructuring and asset impairment charges and lower revenue, the price closed with a 5% drop.

It is always a bad sign when on the day of earnings report the stock close lower. AVY reported a fall in revenue of 13% and a plunge in earnings of 84% quarter vs. quarter.

I believe the 65% price increase since March 9 is market and group related and that the stock is ready for a correction.

Order

Sell short 125 AVY, 27 stop 26.87 limit

Tuesday, April 28, 2009

Sunday, April 26, 2009

This blog is all about stock trading, I will be constructing and maintaining a 50K hypothetical portfolio. All my trades are based on technical analysis although I like to make a brief check of the fundamentals.

I like to keep a 15 stocks portfolio at all times either short or long. Sometimes I have short and long positions together, but most of time I trade only one side of the market.

Buy and sell orders will be posted here and also stops and limits.

For my first pick I’ll do a technical analysis of a stock I’m willing to sell short.

SHORTING HMSY

Hmsy is a weak stock compared to the Sp 500, since March 10 the SP has gained 27.5% while hmsy has dropped from 32.2 to 29.22 for a dismal 9% loss.

HMSY is trading below the 50 day sma. My first order is

Sell short 110 HMSY at 28 stop 27.87 limit

I like to keep a 15 stocks portfolio at all times either short or long. Sometimes I have short and long positions together, but most of time I trade only one side of the market.

Buy and sell orders will be posted here and also stops and limits.

For my first pick I’ll do a technical analysis of a stock I’m willing to sell short.

SHORTING HMSY

Hmsy is a weak stock compared to the Sp 500, since March 10 the SP has gained 27.5% while hmsy has dropped from 32.2 to 29.22 for a dismal 9% loss.

HMSY is trading below the 50 day sma. My first order is

Sell short 110 HMSY at 28 stop 27.87 limit

Subscribe to:

Posts (Atom)

Followers

Blog Archive

About Me

- Erick Stern

- From the Dominican Republic - Swing Trader Speculator - Civil Engineer/Project Manager - sternloinaz@gmail.com